December 23, 2022

December 23, 2022

Cash Flow Factor Performance

Nothing about markets is ever obvious until after the fact. Looking back it’s always abundantly clear which direction things were headed and what we should have done differently, but after going through a few of these cycles in real time I can honestly say, from school-of-hard-knocks experience, that trying to time the market is indeed a fool’s errand. Fighting the urge to get off the rollercoaster during its most gut-wrenching periods takes all the discipline one can muster sometimes. With the S&P 500 bumping its head off the downward-sloping 200-day moving average for the third time this year it’s getting awfully obvious that the rally from the October lows has run out of steam. Sit it out and get back in at lower levels – that’s the temptation. But we know for certain that excess activity breeds mistakes that compound. If I’m looking out 5 years from now, those with discipline during these frustrating times are the ones who come out ahead.

However, some things indeed are obvious and can be capitalized on. If we’ve met in person you’ve probably heard me talk about money supply, liquidity, and the difference between long and short-duration equities. Some definitions:

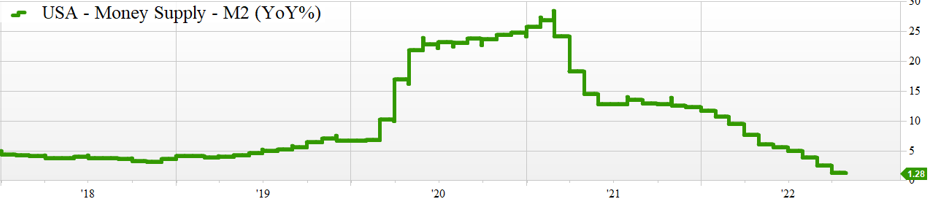

M2 Money Supply is a broad measure of how much money is floating around in the economy in the form of cash, money markets, CDs, or other cash-like securities. It can be manipulated and managed by the Federal Reserve through bank reserve requirements, the Fed Funds rate, and outright open market operations. Generally, the Fed seeks to expand the money supply during times of economic stress and reduce the money supply when called to fight inflation. Fed cycles usually go on for a while and their actions have a significant impact on what types of equities work best.

Long-duration equities – companies with big long-term growth prospects. They typically have a higher-than-average level of debt on the balance sheet and strong top-line growth. Net income may be negative, and they generate very little or likely negative free cash flows. These stocks work very well when the discount rate on future cash flows is negligible and market liquidity is abundant. When the Fed is printing money, this is where it goes. Many of these companies don’t survive when higher borrowing rates are introduced and the access to capital to fuel their business dries up.

Short-duration equities – companies that generate a lot of free cash flow. These are typically well-run businesses that generate positive earnings and a high amount of free cash for every dollar in sales. They can fund their own growth initiatives internally and aren’t at the mercy of capital markets to run their business. They usually carry a cheaper multiple as they don’t have any pie-in-the-sky growth story to tell. They simply run their business, generate cash, and usually pay a good dividend.

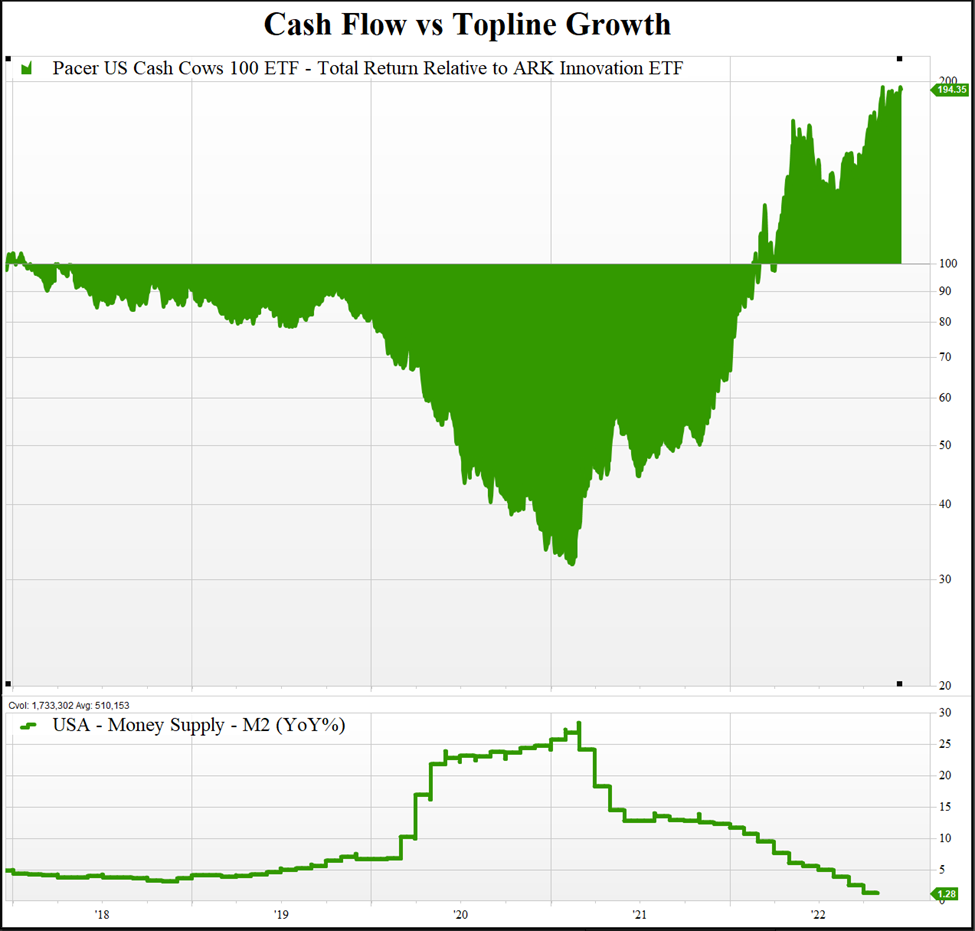

The past year has been a great example of how liquidity and money supply affect the market’s equity duration preferences. The chart below paints this picture clearly. The bottom chart is the year-over-year growth rate in US Money Supply. The top chart represents the performance of a basket of high free cash flow names relative to futuristic, long-duration, highly speculative equities. It was obvious in late 2020 that high-growth speculative tech was the place to be, because money was everywhere, and free cash flow, at that moment, didn’t mean anything. Who needs cash flow when money is free? Users, subs, and sales growth were all that mattered. How interesting that the very moment M2 growth began slowing, the companies that weren’t relying on free money to drive their business roared back into favor. It was obvious.

Source: Factset. Chart generated 12/16/2022

< Return to Insights