September 9, 2022

September 9, 2022

The Long-Term Impact of Demographics

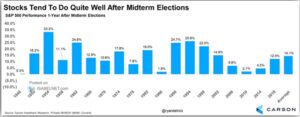

Our last note we sent centered around the dynamics of the mid-term election cycle and how mid-term years are notoriously choppy with larger than average drawdowns. The good news is that 1-year returns after mid-terms are generally much better than average.

This week’s topic zooms way out to look at a concept which will influence long term relative returns – demographics.

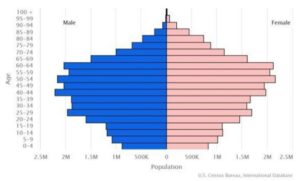

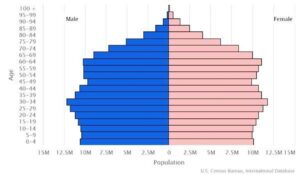

Given the abundance of choices on where to place your equity allocations across the globe, one factor we like to be aware of is the demographic makeup of markets we’re investing in. Economics is simply the story of what people do, and different age cohorts do different things with money. Young people spend and save differently than their parents or grandparents. A young family of four is likely aspiring to upsize their house and buy a second car, needing mortgages and car loans. Grandparents meanwhile are looking to sell the house and downsize to a townhome. They’ll have liquid assets to manage and likely won’t be taking on any new debt.

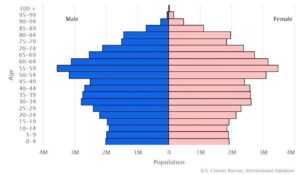

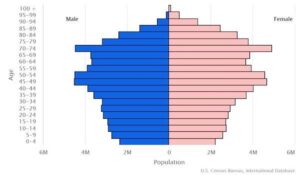

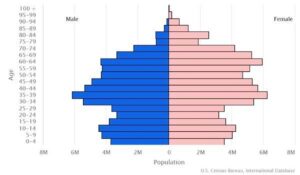

A picture of a country’s demographics can help inform how dynamic its economy will be going forward. A rapidly aging economy creates deflationary pressure as loan growth slows, while a baby boom will typically lead to inflationary pressure and higher interest rates 20-30 years down the road.

Over the past week we’ve been reducing our exposure to international markets. With 40% of S&P profits originating overseas, we don’t feel that directly allocating direct added allocations to these markets offers enough diversification benefits to offset what is clearly a better long-term outlook here in the US relative to those markets.

Demographics aren’t the only factor we consider, but we certainly don’t think the structure of a nation’s population should be ignored either. Below are a few population pyramids we find interesting. Take a look and imagine what the next 20 years will look like for these countries. This is a subject I love exploring so if you have any questions or thoughts please don’t hesitate to give us a call.

Germany

Japan

Russia

South Korea

USA

< Return to Insights